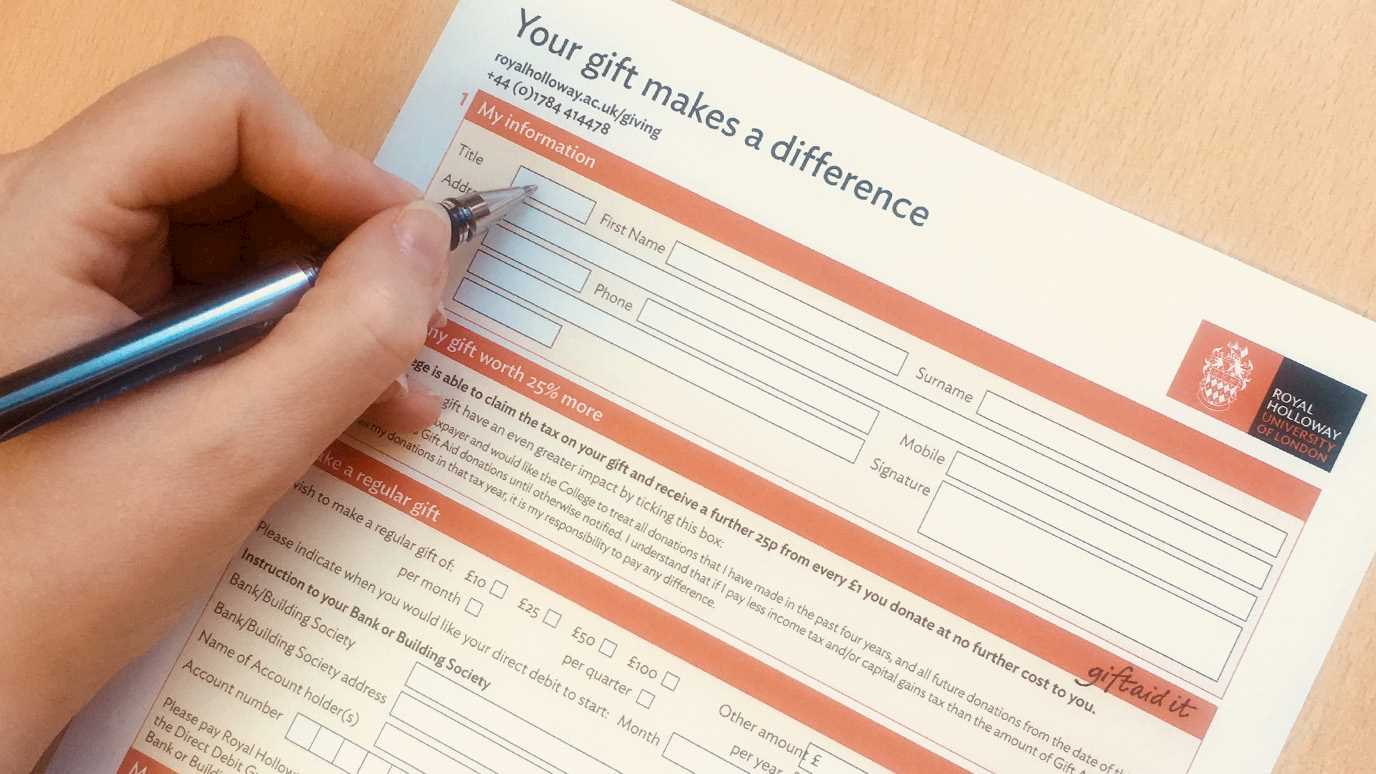

Tax-efficient giving helps us make the most of your donation.

Currently donors in the UK and the USA can make tax-efficient gifts – we are looking at how to extend this to other countries too.

To donate from outside the UK or USA, please email us.

Gift Aid it

The College is able to claim the amount of tax you have paid back, meaning that for every £1 donated to the College, we can claim an additional 25p.

Higher rate tax payers and also claim further relief by detailing your donation in your annual tax return. For more information see HMRC's pages on Gift Aid.

In order for the College to reclaim the tax you have paid on your donation(s), you must have paid an amount of UK Income Tax and/or Capital Gains Tax for each tax year (6 April one year to 5 April the next) that is at least equal to the amount of tax that the College will reclaim on your donation for that tax year (currently 25p for every £1 you give).

To make a tax efficient donation, simply sign the Gift Aid declaration and return to the Development Department . It is also possible to make a verbal Gift Aid declaration if you are donating over the phone.

Payroll giving

Payroll Giving or 'Give as you Earn' is probably one of the easiest and most flexible ways of donating to a charity. This method allows an employee to give a regular or single amount direct from their income to a charity. The pledged amount is deducted after National Insurance contributions are calculated but before PAYE tax is deducted. The donation is therefore tax-free for the donor and the tax the donor would have paid goes straight to the charity instead.

If your place of employment operates a payroll giving system, you can elect to contribute to the College. Some companies also undertake a 'matched giving' scheme that means that they can double (or even more in some cases) any donations you make to a charity in this way. We have provided a list of companies operating a matched giving scheme, but this list is not exhaustive so please check with your employer if it is not on the list.

For further information visit the Give As You Earn section of the Charities Aid Foundation website, email the Development Team, call +44 (0)1784 917677 or for College staff members, complete the Payroll form here and email it to the Development Team.

Giving shares

Giving shares is one of the most attractive methods for maximising the value of a gift to the College whilst minimising income and Capital Gains Tax liability to the donor. Donated shares are free of Capital Gains Tax and the value of the shares at the time of transfer can be offset against Income Tax liability.

The College can accept share gifts of any size. You might hold windfall shares as a result of a privatisation or demutualisation. Alternatively, you might feel able to dispose of shares which are no longer part of your investment strategy. All share gifts are of course important and greatly appreciated.

Tax relief is available to UK taxpayers donating:

- Shares and securities listed on the UK Stock Market, the Alternative Investment Market and recognised stock exchanges overseas

- Units in a UK unit trust; and,

- Shares in a UK open-ended investment company (OEIC).

Donors can claim Income Tax relief equal to the market value of the shares on the day the gift is made, plus any associated costs such as the broker’s fees. In addition, Capital Gains Tax that you may have incurred on any increase in the value of the shares since you bought them will not apply.

| Gift of shares worth: | £1000 |

| Value of shares donated: | £1000 |

| Broker’s fees: | £50 |

| Amount available to deduct from income: | £1050 |

| Income tax relief for higher rate taxpayer: | £420 |

| ‘Cost’ of gift to a donor paying higher rate tax: | £630 |

Please see the examples below which illustrate the power of giving shares:

Example one:

Donating shares originally purchased for £10,000 which are now worth £25,000 will bring £25,000 to the College but higher-rate taxpayers will receive income tax relief of 40% x £25000. In addition, by donating them to the College rather than selling them to fund a donation, a donor will save 40% x £15,000 (a Capital Gains Tax saving of £6,000). The true cost of a £25,000 donation in this example would therefore be just £9,000.

Example two:

Shares on a start up business are now worth £1million. If an amount of shares worth £100,000 were donated to the College this would save £40,000 in Capital Gains Tax. If the income of the donor in that year is £250k they would be taxed on £150,000 (250K minus the value of the 100K gift). So the individual would only be taxed on an income of £150,000 which would save £40,000 in income tax. The net cost of a £100,000 gift in this example would therefore be £20,000.

Please note: We strongly recommend that those wishing to donate shares consult their tax adviser before doing so, as the exact benefits depend on the capital growth of the shares and an individual’s tax situation.

To make a gift of shares, please email the Development Team or call +44 (0)1784 917677 in the first instance, so that we can help to arrange the transaction.

Giving land or property

The College can accept gifts of land or property in a donor’s lifetime, and these gifts now attract the same tax incentives as gifts of shares. Tax relief applies to any property, large or small, providing that the whole interest in the property is donated and the College has agreed to accept it. Please note that relief cannot be carried forward or back a tax year if the donor has insufficient income during the year in which the gift is made to make full use of their eligible deduction.

Tax relief is given for the market value of the property as a deduction from the donor’s income chargeable to income tax for the tax year in which the gift is made. The Income Tax relief is in addition to any exemption from Capital Gains Tax that may also be available to the donor. All the tax relief goes to the donor of the property.

If you would like to discuss giving land or property to the College, please email the Development Team or call +44 (0)1784 917677.

Giving from the US

We have recently changed the method by which we receive donations from US. Please visit our Giving from the US webpage

Corporate matched giving

Corporate gift matching schemes enable you to increase the value of your gift to the College thanks to your employer matching some or all of your donation.

If like the College, your place of employment operates a payroll giving system, you can elect to contribute to the College. Some companies also undertake a 'matched giving' scheme that means that they will double (or even more in some cases) any donations you make to a charity in this way. We have a list of companies operating a matched giving scheme, but this list is not exhaustive, so to be certain, please check with your employer.

If your company does have a matching scheme they should be able to advise you how to take part and make the value of your gift to the College even greater.

For further information or to organise matched giving through your company, please contact Helen Longworth on +44 (0)1784 917677